Good morning.

The Fast Five → Global stocks fall as recession fears grow, Judge rules Google is an illegal monopoly, Wall Sreet 'fear gauge' logs record jump, Asia stocks rebound after day of wild selling worldwide, and JPMorgan trading desk says ‘getting close’ to buy-the-dip opportunity …

From Weiss Research: Former hedge fund manager who called dot-com crash issues warning »

Poll: What is happening in the US market?

Calendar: (all times ET) - Full calendar

Today: US trade deficit, 8:30 AM

Tomorrow: Consumer credit, 3:00 PM

Your 5-minute briefing for Tuesday, August 6:

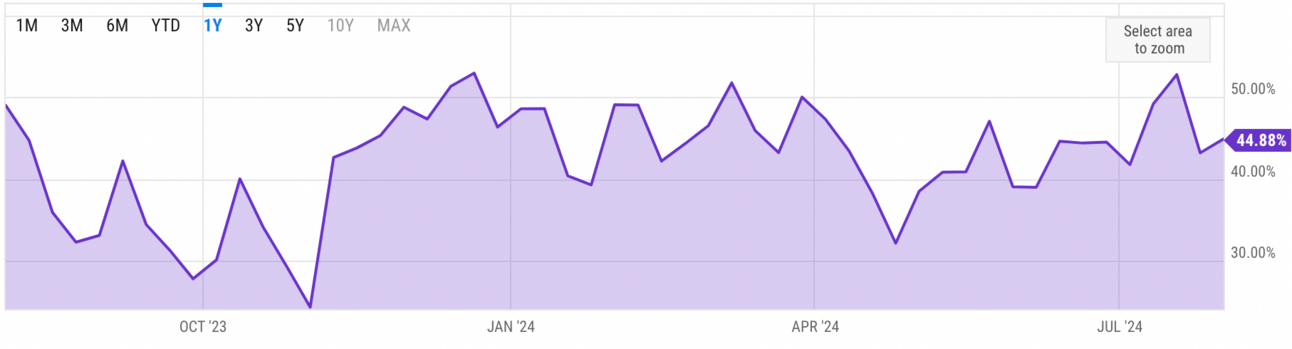

US Investor % Bullish Sentiment:

↑44.88% for Wk of August 01 2024

Last week: 43.17%. Updates every Friday.

Market Wrap:

S&P futures +0.9%, Nasdaq +1.2%, Dow +0.6%

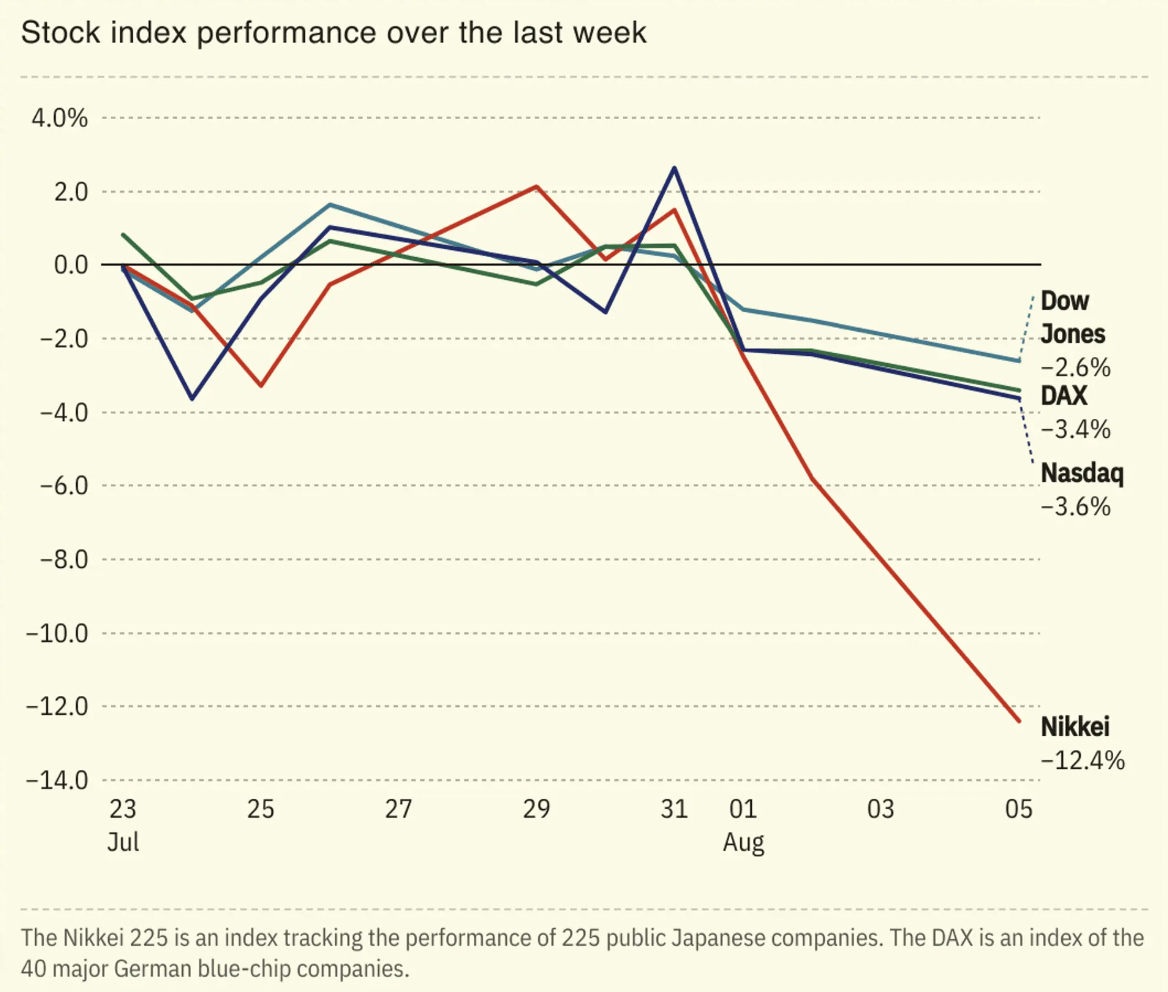

Regular trading sharp sell-off: Dow -2.6%, S&P -3%, Nasdaq -3.43%

Weak jobs report sparks recession fears, concerns Fed behind on rate cuts

Japan’s Nikkei 225 had worst decline since 1987

US Treasury yields fell as investors sought safe-haven bonds

Cboe Volatility Index surged to 65, highest since 2020

Palantir +13%, Lucid Group +6% on strong quarterly results

EARNINGS

Here’s what we’re watching this week:

Today: Airbnb (ABNB), Amgen (AMGN), Instacart (CART), Reddit (RDDT), Restaurant Brands (QSR), Rivian (RIVN), Uber (UBER)

Caterpillar (CAT) - earnings of $5.54 per share on $16.7B revenue (-3.7% YoY)

Robinhood (HOOD) - earnings up $.15 per share on $634.2M revenue (+30.5% YoY)

Walt Disney (DIS) - earnings of $1.19 per share (+15.5% YoY) on $23.0B revenue (+3.1% YoY)

Full earnings calendar here.

TOGETHER WITH WEISS RESEARCH

CNBC's 'Prophet' Who Called Dot-Com

Crash Issues Controversial Warning

As AI stocks sent the stock market to new highs every other month, the mainstream media warned investors to prepare for another 2000-style tech crash.

But the man CNBC nicknamed 'The Prophet' is going against the crowd.

He accurately predicted the dot-com crash in 2000, and today, he has a controversial new warning about the AI craze.

It could dictate your next decade of success – or failure – in the U.S. stock market.

- sponsored message -

HEADLINES

$1 trillion wipeout - market rout punishes megacap tech (more)

Investors are unwinding the biggest ‘carry trade’ the world has ever seen (more)

Wall St 'fear gauge' logs record jump as investors bet on more turbulence (more)

JPMorgan trading desk says ‘getting close’ to buy-the-dip opportunity (more)

Traders bet on Fed emergency rate cuts, but officials need more to react (more)

Fed's Goolsbee says central bank will 'fix' US economy if it deteriorates (more)

Asia stocks rebound after a day of wild selling worldwide (more)

Dollar down as US rate cut bets rise (more)

US crude oil falls to six-month low as market sells off (more)

Survey: Home prices will stay high even if the Fed cuts interest rates (more)

Palantir surges on outlook for earnings and software business (more)

US banks report best loan demand in 2 years (more)

Elliott breaks down Southwest ownership in new regulatory filing (more)

DEALFLOW

M+A | Investments

Quantum Capital to buy Cogentrix for $3B in bets power demand rising (more)

David Beckham-backed Guild Esports set for takeover by DCB Sports (more)

L'Oreal acquires 10% stake in dermatology company Galderma (more)

SocGen to sell UK, Swiss private bank units for about $1 bln (more)

Hims to buy compounding pharmacy to make weight-loss drugs (more)

Woodside to buy Texas Clean Ammonia Project for $2.4B (more)

Accenture acquired Bolsan, a provider of management services for large infrastructure projects (more)

ECI Software Solution, cloud-based business management software, acquires ProfitKey International LLC, an ERP platform for discrete manufacturers (more)

Intellias, a software engineering and digital consulting company, acquired NorthLink Digital, an IT consultancy for financial services and insurance (more)

OppFi, a mission-driven specialty fintech platform, announced acquired 35% equity interest in Bitty Advance, a credit access company (more)

Vital Care, a franchisor of infusion therapy pharmacies, received a strategic investment (amount was not disclosed) (more)

VC

Groq, a company specializing in fast AI inference, has secured a $640M Series D, at $2.8B valuation (more)

Muon Space, an end-to-end space systems provider, raised $56M in Series B funding (more)

Savvy Wealth, a digital-first platform for financial advisors, raised an additional $15.5M funding (more)

Amlogenyx, Inc., a subsidiary of Ultragenyx Pharmaceutical, Inc. researching therapies for Alzheimer’s other amyloid diseases, completed a seed funding round of $14M (more)

Hedra, a provider of AI-powered tools for generating video content with human characters, raised $10M in seed funding (more)

Hyperbolic, a provider of GPU resources and AI services through a cloud platform, raised $7M in seed funding (more)

NanoHive Medical, a company specializing in 3D-printed titanium spinal interbody fusion devices, raised $7M in Series C funding (more)

Skillfully, a company specializing in simulation-driven hiring solutions, raised $2.5M in seed funding (more)

LoanBYE, a company providing student loan relief solutions as an employer benefits package, received a 300K investment (more)

CRYPTO

BULLISH BITES

🚨 Free Download: How to Profit in a Collapsing Market *

💔 Break Up: OpenAI co-founder Schulman leaves for Anthropic, Brockman takes extended leave.

🔎 Inside Look: Why Starbucks is losing customers.

🔥 Hot List: 38 startups have become unicorns so far in 2024: Here’s the full list.

👜 China Luxe: A new generation of premium brands is taking made-in-China upscale.

What did you think about today's briefing?

Have a comment or suggestion?

💌 Send us a message

*from our partners

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.