Good morning.

The Fast Five → America’s fiscal situation threatens good mood on Wall St, CATL rises in debut after world’s top listing in 2025, Moody’s downgrade continues to grip bond markets, Nippon Steel ups ante for US Steel by $11 billion, and tetail traders go on record dip buying spree…

📌 Buffett. Griffin. Abramovich. Koch Brothers. Congress. They're all quietly investing in the same $20 stock. (ad)

Calendar: (all times ET) - Full Calendar

Today:

None scheduled

Tomorrow:

Initial jobless claims, 8:30A

Existing home sales, 10:00A

Your 5-minute briefing for Tuesday, May 20:

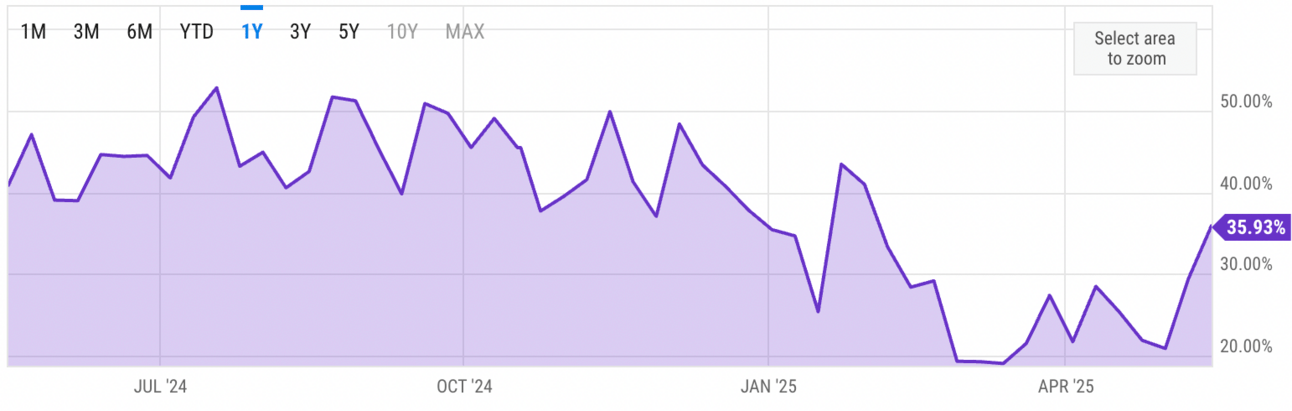

US Investor % Bullish Sentiment:

↑ 35.93% for Week of MAY 15 2025

Previous week: 29.45%. Updates Friday.

Market Wrap:

S&P futures flat; Nasdaq, Dow barely moved

Monday: S&P +0.09%, Dow +137 pts, Nasdaq +0.02%

S&P now within 3% of record high after 6-day win streak

Rally defies tariff fears, Moody’s US downgrade

Carson’s Detrick: 20% gain in 27 days “not a bear rally”

EARNINGS

Here’s what we’re watching this week:

Today:

Home Depot $HD ( ▲ 0.97% ) - earnings of $3.59 per share (-1.1% YoY) on $39.1B revenue (+7.5% YoY)

Wednesday: Lowe’s $LOW ( ▲ 0.78% )

Snowflake $SNOW ( ▼ 3.74% ) - earnings of $.21 per share (+50% YoY) on $1.01B revenue (+21.3% YoY)

Target $TGT ( ▲ 0.89% ) - earnings of $1.70 per share (-16.3% YoY) on $24.4B revenue (-0.4% YoY)

Thursday: Ross Stores $ROST ( ▲ 0.53% ), Workday $WDAY ( ▼ 1.58% )

The $20 Stock Billionaires & Congress Are Buying

Buffett. Griffin. Abramovich. Koch Brothers. Congress.

They're all quietly investing in the same $20 stock

Why? It sits in a sector that impacts $85 trillion in economic activity - that's 13x bigger than oil.

And the AI revolution could send this stock soaring.

- from Weiss Research

HEADLINES

30-year Treasury yield tops 5% briefly after Moody’s downgrade (more)

Moody’s downgrade continues to grip bond markets (more)

House Republicans’ proposed tax on remittances spooks financial sector (more)

China says US undermined trade talks with Huawei chip warning (more)

Retail traders go on record dip buying spree, calming a jumpy market (more)

Wells Fargo says to buy US stocks and cut EM after strong rally (more)

Dollar set for more weakness as 'Brand USA' falls further out of favor (more)

Mortgage rates cross back over 7% after US credit downgrade (more)

Asian stocks advance after rebound on Wall Street (more)

China cuts key rates to aid economy as trade war simmers (more)

Ray Dalio: Rsk to US Treasurys is greater than what Moody’s is saying (more)

Nippon Steel is now willing to pay $11 billion more for US Steel (more)

Google decided against offering publishers options in AI search (more)

Lutnick divests Cantor Fitzgerald to his children, 26North (more)

DEALFLOW

M+A | Investments

Nippon Steel pledges $14 billion investment in US Steel deal

Blackstone acquires TXNM Energy for $11.5 billion

Regeneron to acquire 23andMe for $256 Million

The Hackett Group acquires Spend Matters

Boomi, an AI-driven business automation company, acquired Thru, a provider of enterprise-grade managed file transfer solutions

Virtana, a company specializing in deep hybrid-infrastructure observability, acquired Zenoss, an IT service monitoring and AI event intelligence company

Responsive, an AI-powered SRM software provider, acquired Bidhive, a bid and proposal management platform

Press Ganey Forsta, a provider of experience measurement, data analytics, and insights, acquired InMoment, a customer experience technology company

Keyfactor, a provider of identity-first security solutions, acquired InfoSec Global and CipherInsights

Teleskope receives growth investment from SEVA Growth

Olaris receives investment from Bruker Corporation

VC

Dazos, a CRM platform for behavioral health providers, raised $25M in Series A funding

BreachRx, an incident response platform for enterprises, raised $15M in Series A funding

Persist AI, a pioneer in AI-driven robotics for pharmaceutical formulation, raised $12M in Series A funding

LIS Technologies, a proprietary laser technology company, raised $11.93M in funding

Finwave Semiconductor, a semiconductor manufacturing company, raised $8.2M in funding

Button Finance, Inc., a fintech company focused on home equity lending, closed a strategic $5M Series A funding round

RoboForce, an AI robotics startup, raised $5M in additional funding

Theo Ai, an AI-driven prediction platform for litigation, raised $4.2M in Seed funding

CRYPTO

BULLISH BITES

📈 This top AI stock just hit "Buy Now" territory. *

🇺🇸 How Trump is sparking a crypto revolution in America.

🤖 Could AI end the ETF boom

🙏 Microsoft helped kick off the AI boom. It needs humans more than ever, CEO says.

✈️ How airlines are trying to win over private-jet passengers.

DAILY SHARES

What did you think of today's Briefing?

Have a comment or suggestion?

💌 Send us a message

*sponsored message

Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team.