☕️ Good Morning. TGIF

The Fast Five → Biden’s Oval Office address makes case to fund Israel, Powell leaves door open to hike, U.S. State Dept issues ‘worldwide caution’ alert, big banks quietly cutting thousands of employees, and Treasury yields edge toward 5% for first time since 2007…

Here’s your 5-minute MarketBriefing for Friday:

BEFORE THE OPEN

As of market close 10/19/2023.

MARKETS:

Stock futures dip on rising 10-year Treasury yield.

Dow futures down 0.2%, S&P 500 down 0.3%, Nasdaq 100 down 0.4%.

10-year Treasury yield tops 5% for the first time in 16 years.

SolarEdge shares fall 21% on Q3 revenue guidance cut, while Knight-Swift Transportation gains 15%.

Stocks react to Fed Chair Jerome Powell's inflation and rate remarks.

Market expects no November rate hike, with a 92% probability of no change.

Major indexes headed for weekly losses: S&P 500 down 1.2%, Nasdaq down 1.7%, Dow down 0.8%.

Earnings reports expected from Comerica, Regions Financial, American Express, and SLB.

EARNINGS

NEWS BRIEFING

Israel War Latest:

Treasury yields edge toward 5% for first time since 2007 (more)

US Treasuries at 5% are a buy, Morgan Stanley says (more)

Blackstone warns of looming hit to consumers from surge in bond yields (more)

US weekly jobless claims hit nine-month low (more)

Americans must earn $114,000 a year to afford a typical home (more)

UAW workers at ZF plant in Alabama ratify labor deal, end strike (more)

Trump is winning over swing-state voters wary of Biden’s economic plan (more)

Big banks are quietly cutting thousands of employees, and more layoffs are coming (more)

Walgreens to settle Rite Aid investors' merger claims for $192 million (more)

Corporate America weighs risks of the Ozempic effect (more)

New York sues crypto firms for alleged $1 billion fraud, cites SBF hedge fund bet (more)

Meta, Apple and Google cheer FCC ruling that could pave the way for new AR and VR applications (more)

As Google pushes deeper into AI, publishers see fresh challenges (more)

Shein, the fast fashion darling mulling a U.S. IPO, opens up about forced labor, data privacy (more)

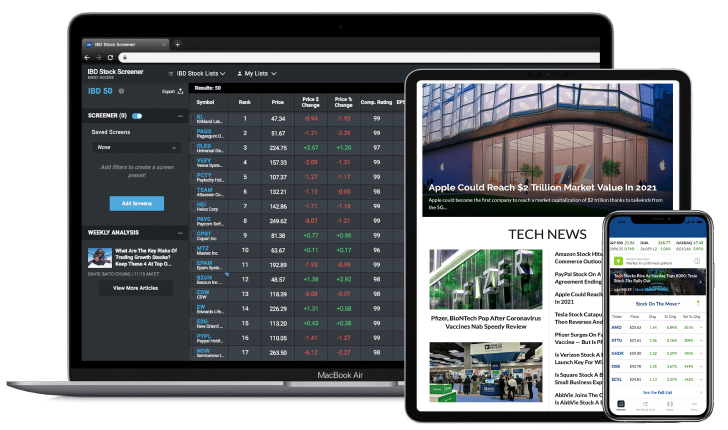

TOGETHER WITH INVESTORS BUSINESS DAILY

Experience IBD Digital for just $1.

IBD Digital gives you an edge in the market with one-of-a-kind investing tools and analysis designed for investors at every level. Try IBD Digital now for one full month and get…

✅ Unlimited access to IBD Digital across platforms and devices

✅ Access 14 exclusive IBD stock lists

✅.Proprietary investing tools & IBD ratings for 5,000+ stocks

✅ Best-in-class training webinars, podcasts, videos and more

Don’t miss out on this limited-time offer you won’t find anywhere else!

DEALFLOW

Pfingsten, an operationally focused private equity firm, closed its sixth investment fund, Pfingsten Fund VI, with total capital commitments of $435M (more)

HqO, a provider of a real estate experience platform, raised over $50M in Series D funding (more)

EnergyX, a lithium extraction and refinery technology company, raised $50M in Series B funding (more)

Debut, a vertically integrated synthetic biology company focused on beauty, raised $40M in Series B funding (more)

Petfolk, a modern veterinary care company providing services for pets, pet owners, and veterinarians, raised $40M in Series B funding (more)

Transfix, a provider of an intelligent freight platform, raised $40M in Series F funding (more)

Position Imaging, a developer of location tracking technologies, raised $30M in funding (more)

EarthGrid Public Benefit Corporation (EarthGrid PBC), a plasma boring technology and infrastructure development company, raised $30M in seed funding (more)

Finzly, a provider of payments infrastructure for financial companies, raised $10M in Series A funding (more)

Pair Team, a provider of a virtual and community-based primary care solution, raised $9M in Series A funding (more)

Ventricle Health, a provider of a virtual cardiology care network, raised $8M in Seed funding (more)

SwingVision, a company on a mission to democratize the professional sports experience for athletes of all levels, raised $6M in Series A funding (more)

Gardenuity, a provider of a curated platform bringing gardening and its wellness benefits to companies and consumers, raised $5.5M in Seed funding (more)

Bluebirds, a provider of an AI powered platform for outbound teams to reach their revenue targets, raised a $5M Seed funding (more)

Beluga, a provider of a crypto platform that onboards and guides new users through their crypto journey, raised $4M in Seed funding (more)

Tia Lupita Foods, a Mexican inspired food brand, raised $2.6M in Seed funding (more)

aPriori, a provider of an end-to-end digital twin solution for manufacturers, received a growth investment from Vista Credit Partners, a subsidiary of Vista Equity Partner (more)

Skipify, a fintech company focused on improving shopping experiences, received an investment from Samsung Next, an investment group within Samsung Electronics (more)

Variantyx, a company specializing in genomic precision medicine, raised additional funding of undisclosed amount (more)

Lovell Minnick Partners invests in ACU-Serve (more)

Charlesbank invests in Petra (more)

Vista Credit Partners invests in aPriori (more)

Pfingsten closes oversubscribed fund VI (more)

KKR closes third tech growth fund at $3B (more)

M & A:

Quext, a technology company for the multifamily industry, acquired Homebase, a provider of a smart building technology platform (more)

Landsea Homes purchases homebuilding assets from Richfield Homes (more)

Consello Capital acquires majority stake in ProSearch (more)

CenterGate Capital purchases Broadtree-backed CTI (more)

Was this briefing forwarded to you? (Sign up here.)

CRYPTO

US Clearinghouse DTCC buys Securrency to deepen blockchain push (more)

New York sues crypto firms for alleged $1 billion fraud, cites SBF hedge fund (more)

NFT market slump shows it’s maturing toward ‘genuine utility,’ execs argue (more)

France rumored to be adopting XRP for digital euro, how will price react? (more)

BULLISH BITES

🦄 Thiel’s Unicorn Success Is Awkward for Colleges → Bloomberg

The billionaire investor’s fellowship has helped build 11 startups valued at $1 billion or more along with a host of other innovative companies — all by enticing smart kids to forgo higher education.

🛠 How to Fix the Internet → MIT

If we want online discourse to improve, we need to move beyond the big platforms.

🍷 Here’s What You’ll Get for $30,000 at Carbone’s New Private Club → Bloomberg

ZZ’s Club, which opens soon in West Manhattan, will feature the inaugural Carbone Privato.

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Subscribe Now

Keep the curation going! Buy the team a coffee ☕️

Have a comment or suggestion for MarketBriefing? We’d love to hear it!

Send us a message -mb