☕️ Good Morning.

The Fast Five → S&P, Nasdaq score longest win streak in 2 years, Xi to meet US business execs for dinner in San Francisco, Elon Musks’s Neurolink now has FDA clearance to start surgery, Biden approval falls to lowest level since April, and Hyundai to build US plant to make first flying electric taxi’s…

Here’s your 5-minute briefing for Wednesday:

BEFORE THE OPEN

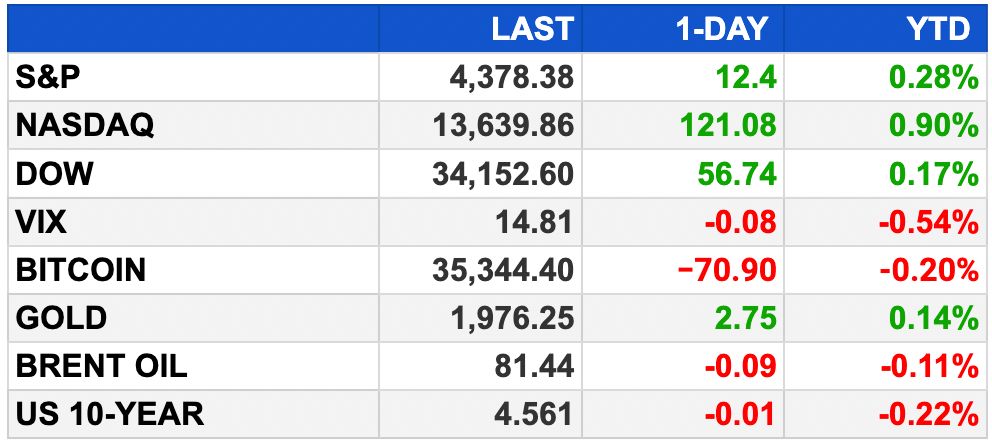

As of market close 11/7/2023.

MARKETS:

U.S. stock futures flat after S&P 500 and Nasdaq extend winning streaks.

S&P 500 and Nasdaq record longest positive runs since November 2021.

Around 80% of S&P 500 companies have beaten earnings estimates, but only 59% have surpassed revenue expectations.

Ongoing equity gains, led by tech stocks, and subdued central bank action could set a positive tone for the market into 2024.

Earnings reports expected from MGM Resorts, Walt Disney, and Take-Two Interactive after Wednesday's closing bell.

September's wholesale inventories data will also be monitored.

EARNINGS

What we’re watching this week:

Today: Arm Holdings (ARM), Walt Disney (DIS), AMC Entertainment (AMC), Twilio (TWLO)

Thursday: Tapestry (TPR)

NEWS BRIEFING

S&P 500, Nasdaq score longest win streak in 2 years on rates view (more)

Biden approval falls to lowest level since April (more)

Biden to meet with UAW president, tout Stellantis plant reopening (more)

Fed’s Goolsbee says ‘golden path’ of a huge drop in inflation without a recession is still possible (more)

US calls for new limits to Wall Street Bank backstop after March crisis (more)

Credit card debt hit new $1.08 trillion record in the third quarter (more)

Baidu placed AI chip order from Huawei in shift away from Nvidia (more)

SoftBank makes another bet on WeWork, hoping landlords will too (more)

Shein reportedly seeks $90 billion valuation in IPO (more)

Food-delivery startup Wonder Group gets $100 million investment from Nestle (more)

Hyundai’s Supernal to build plant in US to make first flying electric taxis (more)

Salesforce CEO says Dreamforce is staying in San Francisco after reaching deal with mayor (more)

Steve Cohen to partner with Hard Rock on bid for $8 billion casino next to NY Mets stadium (more)

Fenway chairman confirms talks with PGA Tour as doubts grow about LIV Golf deal (more)

Private equity courts a growing class of mini-millionaires (more)

After SBF conviction, FTX investors target celebrity endorsers (more)

TOGETHER WITH THE MOTLEY FOOL

Get unlimited access to Stock Advisor.

The Motley Fool helps millions of people like you attain financial freedom through our website, podcasts, books, and premium investing services.

Get Unlimited Access to Motley Fool Stock Advisor today and SAVE $100 off your first year!

DEALFLOW

Bison Ventures, a venture capital firm that invests in early-stage frontier technology companies, closed its maiden fund, at $135M (more)

Enable, an ebate management platform, raised $120M in Series D funding, at $1.12 billion valuation (more)

May Mobility, a company specializing in the development and deployment of autonomous vehicle (AV) technology, raised $105M in Series D funding (more)

Volante Technologies, a cloud payments modernization company, raised $66M in funding (more)

OrsoBio, a clinical-stage biopharmaceutical company, raised $60M in Series A funding (more)

Kythera Labs, a healthcare technology and data analytics company, raised $20M in funding (more)

Needed, a science-backed perinatal nutrition company, raised $14M in Growth funding (more)

Element Eight, a skincare brand, raised $6M in SAFE funding (more)

BioPhy, a company providing an AI operating system to advance promising drug candidates, raised $4.5M in funding (more)

Sock, a provider of a self-custodial crypto investment app, raised $2.8M in Seed funding (more)

Hightower invests in Resource Consulting Group (more)

Rubicon Technology Partners raises $1.7B Fund IV (more)

Harvest Partners closes $5.3B Fund (more)

M & A:

Was this briefing forwarded to you? (Sign up here.)

CRYPTO

BULLISH BITES

💣 Explainer: Why WeWork failed, and what’s next

🤖 An AI just negotiated a contract for the first time ever — and no human was involved

🏝 In Uruguay, a tax haven with lots of beaches and little crime

🌟 Klarna’s financial glow-up is my favorite story in tech right now

😩 Gen Z, millennials have a much harder time ‘adulting’ than their parents did

Know someone who would enjoy this?

What did you think about today's briefing?

Like what you see? Subscribe Now

Keep the curation going! Buy the team a coffee ☕️

Have a comment or suggestion for MarketBriefing? We’d love to hear it!

Send us a message -mb